NYSE Composite Among its suite of indices to measure market performance, the NYSE Composite Index holds a unique position. This index tracks the overall health and performance of companies listed on the NYSE, offering investors an expansive view of market activity.

Whether you’re a seasoned investor or a curious market observer, understanding the NYSE Composite Index is essential for making sense of the broader financial landscape. This post explores what the index is, how it works, its historical significance, and its role in shaping investment decisions.

What Is the NYSE Composite Index?

The NYSE Composite Index is a market-capitalization-weighted index that covers all common stocks listed on the New York Stock Exchange. Unlike other indices that focus on specific sectors or types of companies, this index reflects the movement of the entire NYSE portfolio, comprising domestic and international companies across a wide range of industries.

The index was first introduced in 1965, providing a transparent benchmark to gauge the market’s performance. Over time, the NYSE Composite has become a critical reference point for understanding how the NYSE-listed ecosystem evolves, offering insights into large-cap businesses, mid-cap companies, and emerging players alike.

The NYSE Composite vs. Other Major Indices

To fully appreciate the role of the NYSE Composite Index, it helps to compare it to the S&P 500 and the Dow Jones Industrial Average (DJIA), two of the most prominent U.S. market-tracking indices.

- stock market.

- Unlike the NYSE Composite, the DJIA uses a price-weighted methodology, meaning higher-priced stocks hold more weight in the index. The NYSE Composite’s market-cap-weighted approach makes it more representative of the total money flowing into its listed companies.

Components of the Index

The NYSE Composite Index includes approximately 2,000 individual stocks from the full range of firms traded on the exchange. These span various sectors, including technology, healthcare, financial services, energy, and manufacturing. Both domestic U.S. and internationally headquartered companies listed in the U.S. markets are represented, showcasing the NYSE’s global influence.

This diversity ensures a comprehensive reflection of the market.

How Is the NYSE Composite Calculated?

This means each stock’s contribution to the index is proportional to its total market value (price multiplied by outstanding shares). Essentially, the larger the company, the more influence it has on the performance of the index.

Unlike price-weighted indices, which can be swayed heavily by changes in a single high-price stock, this method ensures that major market movements accurately reflect shifts in the overall value of the companies included.

Adjusted closing prices, rather than raw stock prices, are used to account for events like stock splits or dividends, creating a smoother representation of long-term trends.

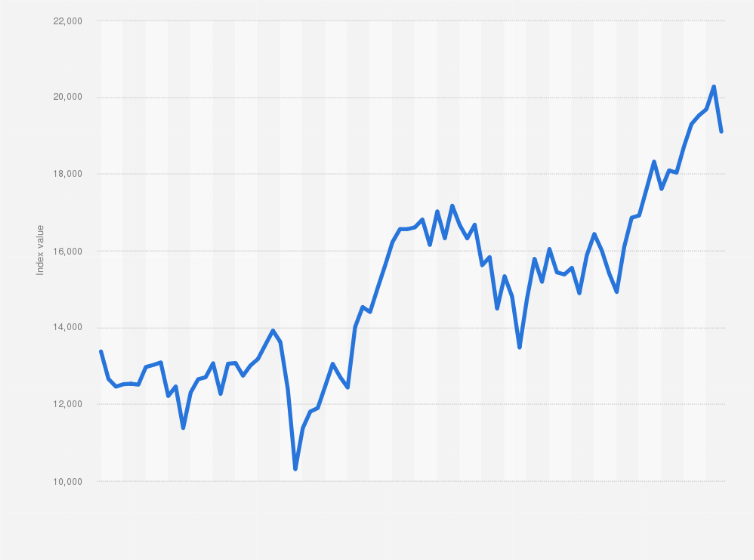

Historical Performance and Key Milestones

Over its history, the NYSE Composite Index has mirrored the general state of the economy and the global financial markets. Here are some notable milestones in its performance:

- 1987 Market Crash: Like all major indices, the NYSE Composite experienced sharp losses in October 1987, also known as “Black Monday,” when markets around the world plummeted.

- Dot-Com Bubble (2000-2002): During the rise and fall of internet-based companies, the index observed significant volatility, as a fraction of its listed tech firms went public and collapsed.

- Financial Crisis (2008): The 2008 economic downturn resulted in substantial drops for the NYSE Composite as financial stock values plummeted. The index lost nearly 50% of its value before recovering in subsequent years.

- Post-Pandemic Boom (2020-2021): Following the global economic lockdowns, Federal Reserve policy and investor confidence brought market growth. The index reflected broad recovery momentum, setting record highs in the process.

While the index reliably highlights periods of economic expansion and contraction, it also underscores the importance of diversification—both sectorally and geographically—which helps mitigate risks associated with regional downturns.

Why Is the NYSE Composite Index Important for Investors?

The NYSE Composite Index serves as more than a mere data point. Its significance lies in its comprehensive coverage, offering investors a snapshot of the health of the economy and industries represented on the New York Stock Exchange.

For professional investors, the NYSE Composite can help benchmark returns against the broadest representation of the market ecosystem. Likewise, individual traders can use it to gauge the overall tone of NYSE-listed stocks and decide how it aligns with their portfolios.

Relevance in a Modern Market

The rise of passive investing, for instance, has seen a growing number of exchange-traded funds (ETFs) and mutual funds tied to broad indices, bringing indices like this one into sharp focus.

Additionally, the NYSE Composite appeals to globally minded investors due to its inclusion of international companies, reflecting the interconnected nature of modern financial markets.

Summary and Key Takeaways

The NYSE Composite Index is an essential tool for understanding market performance at a glance. Unlike the S&P 500 or DJIA, its inclusion of all NYSE-listed companies makes it an expansive market indicator. By tracking movements in the index, investors gain insight into the overall health of industries and companies that form the backbone of global commerce.

From its calculation methodology to its historical trends, the NYSE Composite remains a beacon for investors seeking a holistic snapshot of market dynamics. Whether you’re interested in spotting growth opportunities or evaluating economic resilience, this index is an invaluable resource.

Recent Developments

As of 2025, the NYSE Composite continues to showcase strength in large-cap stocks, driven by resilient performance in the technology and healthcare sectors. While economic uncertainties remain, the index underscores the enduring role of established market leaders in shaping investor sentiment.

For anyone navigating the complexities of the financial world, the NYSE Composite Index offers both a starting point and a reliable benchmark for understanding long-term trends.